Row crop farms in Missouri use various methods of leasing farmland to expand their operations. Leasing farmland allows the operator to benefit from additional acreage without purchasing the ground. Historically, producers have chosen either a fixed cash lease or a crop share lease.

Fixed cash leases are simple but don’t share risks and returns between landowner and tenant. Crop share leases divide risk and returns between landowner and tenant but can be complex. More information on cash and crop share leases can be found at AgLease101.org.

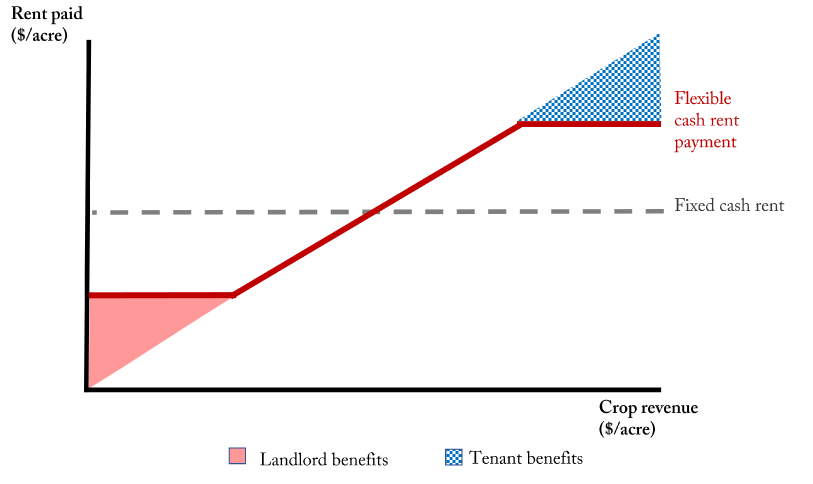

Flexible cash leases, also called variable or hybrid leases, merge desirable aspects of fixed cash and share leases. They split the risk and return between landowner and tenant in a simpler manner than crop share leases. During low-income years, landowners are guaranteed a base lease payment and tenants pay less in rent than if they had a fixed cash lease. During good years, landowners and tenants both share the benefits of higher yields or prices.

How flexible cash leases work

Like fixed cash leases, flexible cash leases obligate the tenant to pay rent to the landowner in cash and the tenant retains ownership of the whole crop. However, flexible cash leases do not establish a fixed annual rent. Rather, flexible cash leases vary annual rental payments based on a selected factor such as gross revenue, crop price, crop yield, revenue minus major expenses, or another agreed upon measurable factor. In this guide, we will focus on leases that flex on gross revenue — calculated as the crop yield times the price.

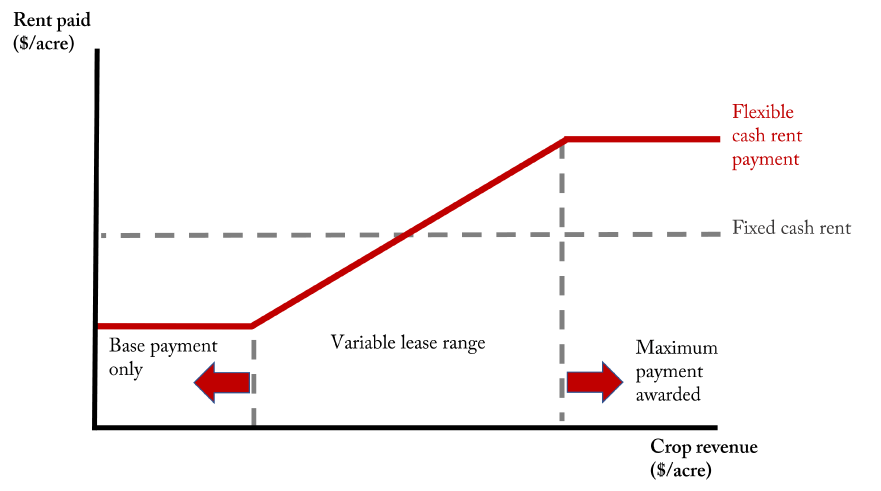

A flexible cash rent consists of a base payment, a payment that varies with revenue and a maximum payment. Key negotiation points in a flexible cash lease include the amount for the base payment, the amount for the maximum payment, and the rent factor used to determine the variable payment. Flexible cash leases do not eliminate the need for a landowner and tenant to find a fair rental rate for the land. Rather, they incorporate the risk-return principle into the fair rental rate to provide advantages to both parties. Figure 1 illustrates rental payments paid as gross crop revenue changes.

Base and maximum payment

The base payment is the minimum rent the landowner will receive. It is usually paid in the spring before production begins. Typically, the base payment will be a percentage of a fixed cash rental rate for the land, if it were leased in that manner. A base payment guarantees the landowner a large portion of their desired annual return. It also allows the tenant to reduce financial risk in exchange for allowing the landowner to share in some of the benefits of higher-than-expected returns.

To protect the tenant’s cash flow in the occasional windfall year, flexible cash leases often specify a maximum rental rate. A maximum rental rate may be either a negotiated dollar amount or a specified percentage above the average cash rental rate.

Variable payment

The variable payment is the flexible component of the lease. It is calculated and paid after harvest — when crop yields and prices are known. Assuming the lease flexes on gross revenue, the total rent is calculated as the final gross revenue multiplied by a rent factor. The variable payment is the total rent minus the spring base payment.

Rent factors

The rent factor is a percentage of revenue that the landowner will receive. Because the landowner is accepting more risk with a flexible cash lease than with a fixed cash lease, the risk-return principle suggests that the expected annual rent from a flexible lease is greater than fixed cash rent. This increase in expected annual rent is accomplished by wisely choosing the rent factor.

Rent factors are important, negotiable aspects of flexible cash leases. They are intended to mirror crop share leases where the landowner provides only land. Rent factors are expected to vary based on soil productivity and demand for farm ground. Less productive ground requires more non-land inputs per dollar of return, justifying lower rent factors. Highly productive ground requires fewer units of non-land inputs per dollar of return, justifying higher rent factors. The rent factor is the primary determinant of the overall value of the lease.

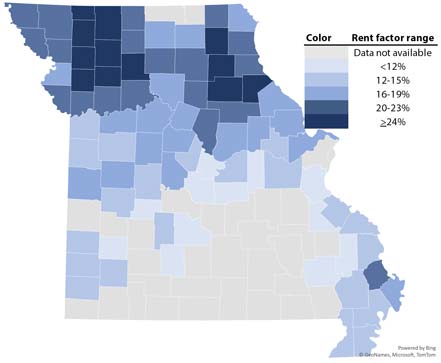

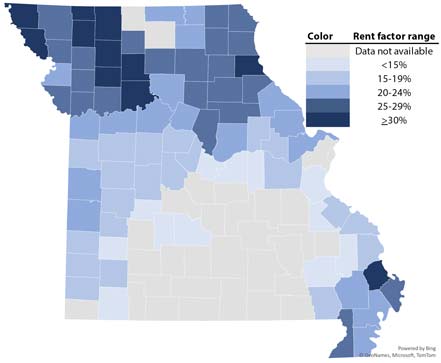

Missouri county-level rent factors for corn range from 8 to 31 percent (see Figure 2) and 9 to 38 percent for soybeans (see Figure 3) averaged over the past 10 years. Highly variable annual crop production revenue necessitates using 5 to 10 years of data to calculate an average rent factor. The rent factor calculated from such data will be more likely to suit both parties for a longer term without renegotiation.

Understanding how rent factors are derived is beneficial when exploring and negotiating a flexible cash lease. Table 1 shows an example of the data used when calculating a long-term average rent factor. Rent factors in Table 1 were calculated using USDA county level rents and Farm Service Agency yield information for a single county in Missouri, combined with Risk Management Agency harvest time price reports.

Table 1. Data used when calculating 10-year average rent factor.

| Rent | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | Average |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fixed cash rent ($/acre) | 107 | 119 | 119 | 146 | 129 | 132 | 131 | 138 | 141 | 146 | 152 | 135 |

| Corn rent factor | 16% | 50% | 22% | 22% | 29% | 21% | 20% | 23% | 21% | 21% | 20% | 25% |

| Yield (bushels per acre) | 108 | 32 | 124 | 191 | 116 | 177 | 186 | 161 | 175 | 173 | 140 | 147 |

| Price ($ per bushel) | 6.32 | 7.50 | 4.39 | 3.49 | 3.83 | 3.49 | 3.49 | 3.68 | 3.90 | 3.99 | 5.37 | 4.31 |

| Soybean rent factor | 29% | 34% | 27% | 28% | 48% | 24% | 24% | 30% | 26% | 24% | 25% | 29% |

| Yield (bushels per acre) | 30 | 23 | 34 | 54 | 30 | 57 | 55 | 54 | 59 | 58 | 49 | 47 |

| Price ($ per bushel) | 12.14 | 15.39 | 12.87 | 9.65 | 8.91 | 9.75 | 9.75 | 8.60 | 9.25 | 10.54 | 12.30 | 10.70 |

Because fixed cash rent provides minimum risk to the landowner, the calculated rental factor would be the lower bound for a flexible lease that adds risk to the landowner. The 10-year average rent factor of 25% for corn in table 1 might be raised to 26% to account for the additional risk to the landowner.

Regional rent factors

Table 2 shows the rent factors calculated by University Extension programs for Missouri, Iowa and Illinois. The rent factors were calculated using available rental rate and yield data. The difference between rent factors for different states and regions demonstrate the importance of soil productivity and geography on rent factors.

Users are encouraged to calculate their own rent factors, as illustrated in Table 1, rather than accept these as appropriate for their farming situation.

Table 2. Rent factors calculated by Missouri, Illinois and Iowa state extension economists.

| State and region | Corn (percent of gross revenue) | Soybeans (percent of gross revenue) |

|---|---|---|

| Northern Missouri | 21 | 26 |

| Southern Illinois | 24 | 31 |

| Northern and Central Illinois | 32 | 43 |

| Iowa | 33 | 43 |

Example of a flexible cash lease

A landowner has been renting land to a farmer for $170 per acre. The tenant wishes to change the fixed cash lease into a flexible cash lease. The tenant proposes the following rental agreement to help reduce financial risk:

- Base rent of $110, paid by March 1.

- Maximum rent paid will be $230, with the balance over the base rent due Dec. 31.

- Rent factors of 23% and 31% of gross revenue for corn and soybeans, respectively.

- Gross revenue determined by multiplying actual yields multiplied by harvest time price reported by the Risk Management Agency (also used in calculating crop insurance indemnities).

To illustrate the proposed lease, the tenant presents the three scenarios utilizing the proposals made above. Table 3 shows the details of each scenario, and the list below describes the function of the lease in each scenario:

- In an average year with average yields and reasonable prices given recent market conditions, the tenant would pay $184 for corn acres and $186 for soybean acres. Assuming the land in the lease is evenly split between corn and soybeans, the landlord would receive $15 more per acre than under the previous fixed cash rent agreement of $170 per acre.

- The high yields and prices scenario results in the landowner receiving $230 for every acre planted to corn. The calculated rent for corn is $253.46per acre, but the maximum rent is established as $230 per acre so the variable rent payment made in fall is $120 per acre. Because the calculated soybean final rent of $225.99 is below the maximum rent, the full calculated rent is received by the landowner with a variable rent of $115.99 per acre of soybeans planted.

- Low yields and low crop prices cause gross crop revenue to be low. This scenario shows the landowner receiving no fall payment for soybean acres since the final calculated rent is less than the base rent. The landowner receives a fall rent payment of $4.89 per planted acre of corn since the final calculated rent exceeds the base rent.

Table 3. Flexible cash lease scenario.

| Crop | Scenario | Yield (bushels per acre) | Price (per bushel) | Rent factor (percent of gross revenue) | Final calculated rent (per acre) | Base rent (per acre) | Variable payment (per acre) |

|---|---|---|---|---|---|---|---|

| Corn | Average year (1) | 160 | $5.00 | 23% | $184.00 | $110.00 | $74.00 |

| Excellent year (2) | 190 | 5.80 | 23% | 253.46 | 110.00 | 120.00 | |

| Poor year (3) | 135 | 3.70 | 23% | 114.89 | 110.00 | 4.89 | |

| Soybean | Average year (1) | 48 | 12.50 | 31% | 186.00 | 110.00 | 76.00 |

| Excellent year (2) | 54 | 13.50 | 31% | 225.99 | 110.00 | 115.99 | |

| Poor year (3) | 33 | 9.20 | 31% | 94.12 | 110.00 | 0.00 |

Adopting a flexible cash lease

Adopters of flexible cash leases typically have one of two purposes. The first is to make a cash-rental situation function closer to a crop-share agreement to mitigate the tenant’s financial risk. With this goal in mind, negotiation will typically settle on a wider range of flexibility. A base payment may be set 30 to 40 percent below the typical cash rental rate for the farm, with a maximum set at a similar percent above. Variable payments will be made in most years, allowing the lease to work as intended and buffering the tenant from shocks in the weather or markets, while keeping landowner returns slightly higher than the average fixed cash lease.

The second purpose is to provide landowners with additional upside in highly competitive leasing environments. Here, landowners will be offered base payments slightly lower than average cash rent with a bonus payment offered if returns to the tenant exceed a specified threshold. This method is frequently used on irrigated farms or areas where below-average yields are rare. A bonus payment style of agreement is usually proposed by a prospective tenant as a negotiating tool in a fixed cash leasing scenario. Including a bonus payment still renders this agreement a flexible cash lease.

Stability in flexible cash leases

Higher prices tend to accompany lower yields and vice versa. This negative price-yield correlation of helps flexible cash leases based on revenue (the product of yield and price) remain appropriate over many years. A decrease (increase) in yield tends to increase (decrease) price to keep gross revenue closer to an average level. Yield-price correlation is not perfect, and local conditions (e.g., local drought) hinder stable revenues. The base and maximum payments protect both parties when revenues fluctuate significantly.

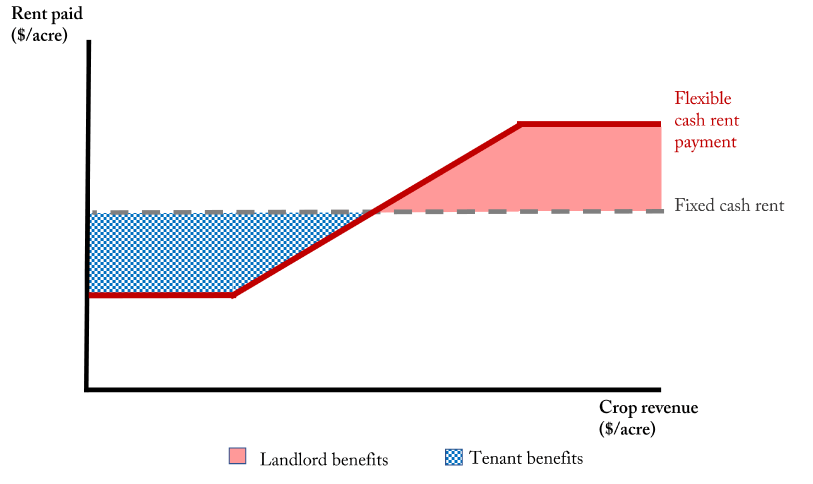

The base payment protects landowners from getting no return on their land. The base payment is necessary for a flexible lease to be considered a cash lease, rather than a crop share lease. Setting a base payment too low may affect the way the lease is viewed for tax and government program purposes. You may want to ask your accountant and the USDA FSA office if your negotiated base payment has any effect on taxes or farm program payments. The maximum payment functions similarly to the base payment, but it will protect the profits of the tenant when production and prices allow revenue to greatly exceed expectations. Figures 4 and 5 show the benefits to both landowner and tenant of flexible cash leases when compared to fixed cash rents and crop-share leases, respectively.

Flexible cash lease considerations

A good time to reevaluate the terms of a flexible cash lease is when the minimum or maximum rental payment is reached. A benefit of a flexible cash lease is that it can last for many years. The percent of revenue obtained by the landowner accounts for yield trends and for changing price levels over time. However, with time, the maximum rental payment may become too constraining given future expectations of price and yields. When a lease is reevaluated, all key points are negotiable.

Choosing a source for price information

Various price information sources can be used in flexible cash leases. Harvest time prices for corn and soybean, as reported by the Risk Management Agency for use in crop insurance indemnities, can be used to calculate the rent factors. Other sources of price information could include local cash bids, futures prices, and USDA price data.

Flexible leases should use the same source of price information for both determining the rent factor and for settling yearly rental payments. Whatever the source of price information, it should be sourced from an independent provider and clearly specified in the lease. An independent source of price information makes calculating final rent payment transparent and accessible for both landowner and tenant.

Record keeping with flexible cash leases

Tenants often have more than one landlord, creating difficulty in separating yields for different farms. Since a flexible cash lease requires the yield for each crop and farm be reported to the landowner, the tenant’s recordkeeping responsibilities may increase. Written leases that record decisions made with different landlords (tenants) facilitate calculation of rental payments with different landlords (tenants). The landowner needs to be confident that the yields reported by the tenant will be accurate before agreeing to a flexible cash lease.

If grain is only weighed in the field with either a combine yield monitor or grain cart scale, it is essential that these instruments are properly calibrated. Grain must also be adjusted for moisture to find dry yield, which is the amount of grain that can be sold. Many modern yield monitors do these calculations automatically. Stating in the lease agreement what percent moisture will be used for final yield reporting, and how moisture adjustments will be made, prevents misunderstanding when calculating the final total rent.

Commodity program payments and flexible cash leases

The tenant will receive all farm program payments and all insurance indemnities in a properly constructed flexible cash lease. Some landowners may want to receive some of the government payments and insurance indemnities by including them in the definition of crop revenue. This guide on flexible cash leases assumes the revenue is yield times price. Including other income sources into the calculation of revenue significantly complicates the flexible cash lease agreement — so much so that a share lease is probably more suitable. For example, some FSA program payments (such as those from the Agricultural Risk (ARC) and Price Loss Coverage (PLC) programs for corn and soybean base acres), are not distributed until October of the year following harvest. Including them would postpone the final rent settlement until a year after the harvest of the crop.

Non-cash points of negotiation

This guide addressed one aspect of a lease: the way in which rent is calculated and paid. Every lease means more to both parties than just the exchange of property rights for income. The tenant may have business plans wrapped up in the lease or be leasing farmland to involve family members in the farm. The landowner may have conservation goals for the leased land. Every lease needs to consider the full range of objectives of both landowner and tenant. These objectives may play an important role in how the lease is written and rental rate determined.

Other resources

The University of Missouri has additional publications available on both fixed cash rent agreements and crop-share leases. Other information can be found in the Farm Leasing category of the Agricultural Business and Policy Extension webpage.

Sources

- Flexible Farm Lease Agreements. 2021. Plastina, Alejandro; Edwards, William; and Johanns, Ann. Iowa State University.

- A Straight-Forward Variable Cash Lease with Revised Parameters. 2022. Schnitkey et al. University of Illinois.